Health-Tech Might be Ready

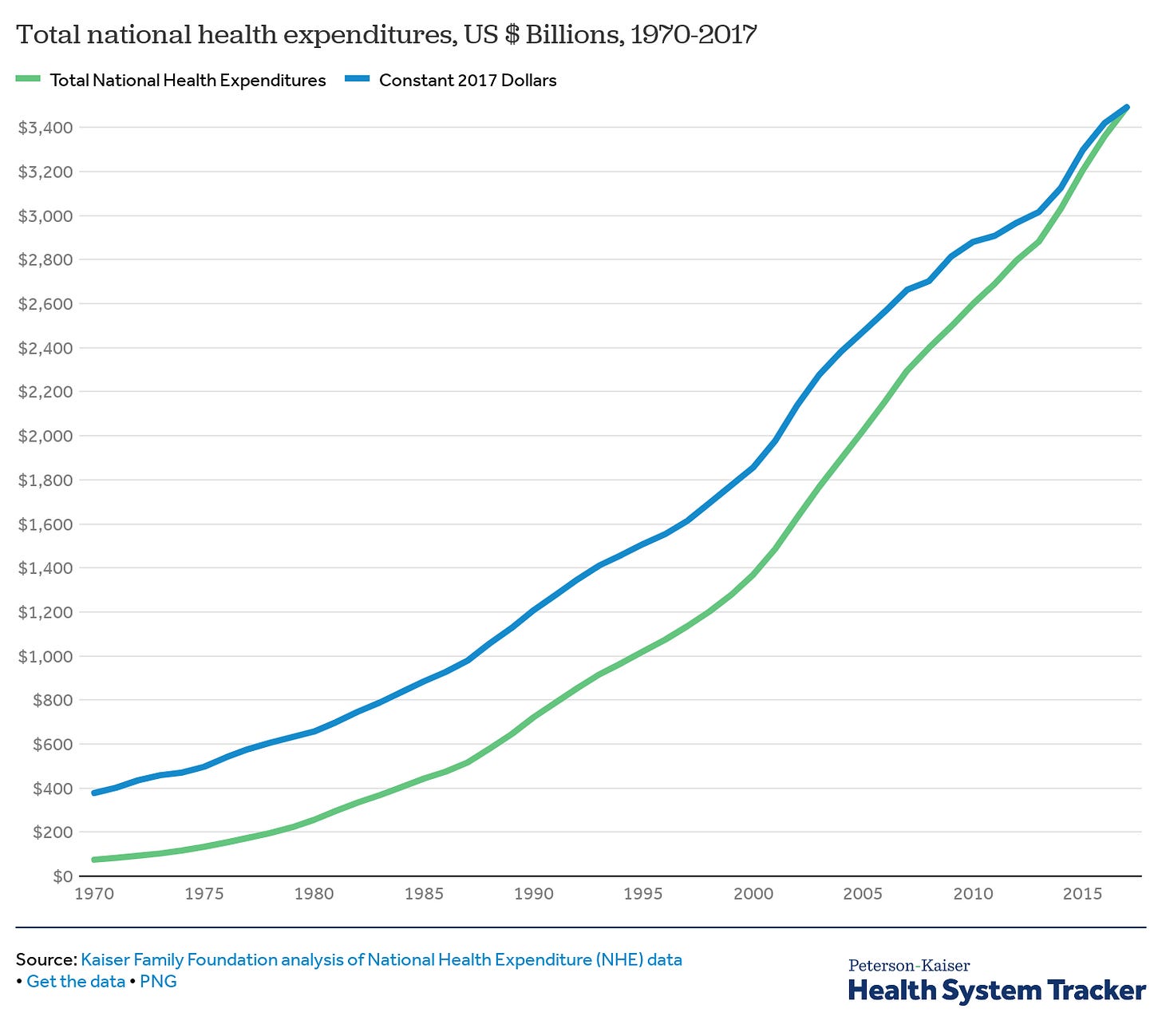

Healthcare tech has underdelivered: Billions has been invested but health costs keep rising and US healthcare outcomes are still bad. But we might see change soon.

Why should you listen to me?

The morass of US Healthcare is personal to me and I know it from the inside.

My father ran a small primary care practice in rural New England. I watched his nights and weekends disappear into the void of admin and billing overhead. Unlike many of my peers, I worked in medical billing after college. This was athenahealth, 2006–2008. Athenahealth was an early success story, and a cofounder went on to be the CTO of the obama whitehouse. I learned from within from some great people.

But athenahealth was an exception, the macro forces in healthcare weren’t right. Name a classic market failure (rent collection, monopoly, principal/agent, broken price mechanisms, etc.), and healthcare has a horrid version of it. A lot of these problems still exist. So what we have seen is a lot of businesses and tech that’s as bad as Kelly Rowland texting on excel:

How doctors feel about a lot of health software

Big, questionably-ethical companies lock and control the value chains. They know they are rent-collecting. They like it.

Hospital chains consolidate so they can charge higher prices without giving better care.

Payers (e.g. insurance companies) consolidate so they can negotiate against those higher prices.

Anti-competitive Electronic Medical Records (EMRs) hide behind privacy laws as an excuse to not interoperate, forcing adoption and absurd price tags. The cost of just installing one of these systems is straight out of the 1980s: Pay billions just to get the chance to start paying for more money later.

EMRs that are built to help with billing, not healing: It’s so hard to get paid in medicine. The EMRs are not built to help doctors. EMRs are built to make the insurance companies pay up, forcing doctors into data entry jobs.

Fee-for-Service: A doctor gets paid to perform a surgery. If they screw up, they can get paid to fix it, too. This should make your skin crawl.

Pharma rent-collects on drug patents, e.g. buying one specific kind of insulin and jacking the price up.

Pharma abuses the FDA to keep charging monopoly rents: Take a drug that’s been around for 50 years, add tylenol to it, re-patent it, keep charging 500x.

Name a market failure and health has it. It’s not an accident that some of the most-hated companies are in health. Just have a look at Purdue Pharma, the drug makers responsible for many hundreds of thousands of deaths.

This is basically some health CEOs, forcing opioid crises and monopoly rent collection onto us.

Healthtech was very important to me. It still is. But the problems were way upstream of technology. So in 2008 I came out to Silicon Valley.

I’ve been waiting and looking for years: I watched behavioral health, health payments, pill distribution, etc. A few good companies have been built. They are the exception. Not much came of it. I’ve been watching health for over a decade now. Waiting. Hoping.

What happened so far?

Quantified-self tools (think: fitbit) didn’t make a dent in America’s behavioral health. Data porn for the already-active, or people cheated their fitbits.

Past disappointments: One Medical had promise: run primary care clinics, with vertically-integrated tech, delivering better care at way lower prices. The tech wasn’t world changing. Instead they backed into holding prime real estate in desirable locations. The medical business happens to be great tenants: high-revenue businesses with very little turnover. (disclaimer: I’m a long-standing and happy customer of One Medical, but they are high-price if you don’t have high-end insurance)

Huge amounts spent on EMRs that were made for billing, not for healthcare. Unsurprisingly, doctors don’t like them and outcomes don’t improve.

Most healthtech cos that help with the plumbing of American healthcare are just shaving pennies from the bigger, entrenched companies:

When health tech value creation in this era is compared to the industry incumbents, it becomes even more clear that success has been heavily skewed [to the incumbents]. The collective value of large cap healthcare companies increased by $1.6 trillion, or nearly 100% (vs. S&P 500 growth of 60%) over the post-reform period. Startups have tended to focus on the existing industry value chain, wedging themselves into a place where they can shave pennies from the incumbents’ flow of dollars (many of which are simply shaving pennies themselves).

This approach is flawed and explains (in part) why there are so many struggling health tech companies; it is the key lesson of the last five years. The vast majority of startups that have focused on ratcheting the industry’s efficiency — on making it function better — limp to a meaningful size, if they ever make it. Health tech companies that want to be big will have to focus on making healthcare different, not just better.

from https://medium.com/@malay/building-a-big-health-tech-company-76f51ab4da64

Why now? What Changed?

Four things:

AppAmaGooBookSoft are making big moves.

Experimental Foundation (e.g. HIPAA compliant AWS).

Startups proving new, effective, different modes of care.

Regulatory changes.

[some redacted information told in confidence]

AppAmaGooBookSoft are making big moves:

Cost disease in healthcare has created a big prize: there’s a lot of good money and good work to do. This pushes all the big tech cos and their massive capital into health.

The large tech companies are putting real weight into it, now.

Apple is testing out iOS-integrated primary care clinics for their headquarters employees, integrating with healthkit. Think: a high-quality walled garden for the well-off. The CEO, Tim Cook, has said that Apple’s biggest contribution to humanity will be in healthcare.

Microsoft is moving into enterprise healthcare management. And that comes with public CEO backing, too.

Amazon purchased Pillpack and partnered with JP Morgan and Warren Buffet to try to rework large health payments.

Facebook has several efforts in health. I personally doubt consumers will trust Facebook with sensitive health data. A research program with a large hospital chain was shut down after the Cambridge Analytica scandal broke.

Google has long had many health initiatives. 23andMe is arguably a Google spinout. Google is the wildcard. The other companies have direct, concrete ideas. Google could surprise with something more open and radical. If Apple is exploring what “the iOS of health” is, what would “the android of health” be? Google tried before from 2008–2011. They may be trying again. I hope they do.

Experimental Foundation:

Over the past few years Google and Amazon have built tech infrastructure to experiment with new company experiments. Think HIPAA-compliant AWS. This means more health companies get started, so more successes can be found.

The FDA process for medical devices also speeds up experimental rates. Does need some fixes, though, as Last Week Tonight rightfully points out.

John talks about the FDA Clearance methods at 6:08.

Theranos, and the great book Bad Blood, both show that the costs of failures in health are immense compared to a social media startup. You can’t build experimental health companies as fast as you would in SaaS. But speeding up what was an anemic experimental rate is a very big deal.

Startups proving new, effective, different modes of care.

Now that the experimental environment is getting better, we are seeing some great companies get started. Just a few examples:

Alto: on-demand same-day delivery for both basic and complicated medications is growing very quickly (exact growth #s not sharable).

Truepill: Stripe for pharmacies that enables HIMS, Romans, Nerx.

Virta: 50% type-II diabetes reversal by year 2, 70% in year one

Pear Therapeutics: FDA certified apps for substance abuse.

Carbon: Delivering on the promise of a company like One Medical: Urgent and Primary Care that is powered by tech to be faster, cheaper, and better.

Elation: Value-based care payments enabled an EMR to be built to deliver better care, not better billing.

What many of these specific solutions lack, however, is aspiration. Nobody wants to show off an app that says “I’m a diabetic”. Aspirational marketing is sorely lacking in health. Nike, Apple, Lululemon, and others know this. A great consumer health brand has to be built on aspiration.

Regulation Changes:

We are seeing some early effects of price-shopping that high-deductible plans incentivized. This helps us move away from Fee-for-Service towards value-based care.

Recall the problem with Fee-for-Service, that doctors don’t have any financial reason to give good care? Michael Porter, one of the best minds on business strategy and value chains has been talking about this for years.

Regs are moving towards value-based care (this is very good)

Health is Ready

Large tech cos are putting their large weight behind it. Regulation is changing, albeit slowly. The environment for startups to experiment is more fertile. Startups are starting to make stuff that really works.